“Successful customer retention starts with the first contact an organization has with a customer and continues throughout the entire lifetime of a relationship.“

From Wikipedia, the free encyclopedia

That’s not how telecom operators did it. Equipment subsidisation became the excuse to lock customers in to long, inflexible, service contracts.

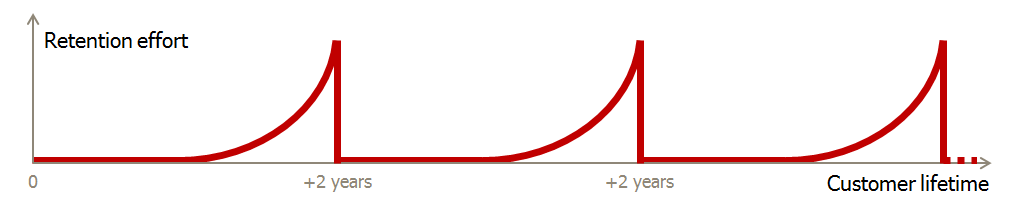

Customer satisfaction was secondary until the point in time close to the end of the customer’s contract when the operator faced a risk of churn. Suddenly, the operator showed a lot of interest in this specific customer and willing to spend both time and money on retention. The retention efforts continued until the customer was signed up for another two-year period – after which he or she was once again left without proactive attention.

If we plot that retention effort against the customer lifetime, it looks something like this.

When subscriber acquisition and subscriber retention cost (SAC/SRC) increased without a reduction in churn – and while the total customer base no longer grew – certain operators realised that this wave-formed retention no longer made sense. They switched to non-binding agreements offering more freedom for customers – and pioneered Nonstop Retention.

The unparalleled results of Free in France and T-Mobile in the US had competing operators follow their lead and apply this new retention model:

Without lock-in the retention effort needs to start from day 1. The effort is the same in the two graphs, so the new model is not about using less effort on retention but about constantly working to win customer loyalty – giving them reasons and incentives to stay.

In the pursuit of customer loyalty – now that lock-in can’t be used – many operators realise that their retention toolbox is empty.

To address this, we have developed the Nonstop Retention Index which helps operators understand how well prepared they are to retain customers while also growing their net intake. We’ve looked at thirty indicators and grouped them into six categories that make up the Index. And compared some of the leading brands across different markets to find out how they score in the Nonstop Retention Index.

We at Tefficient consult operators in how to improve not only their Nonstop Retention Index but also their actual business results when planning for – or following up – a transition into decoupled, non-binding and unsubsidised.

First step? Try our half-day Nonstop Retention Workshop for your management team. We deliver an analysis on your brand resulting in a Nonstop Retention Index, insights and benchmarking with competitors and recommendations for you including examples and proof-points.

Please contact us at info@tefficient.com for more information.