Telenor should be admired for having seen the potential of mobile in developing Asia long before everybody else. Telenor’s operations in e.g. Bangladesh, Pakistan, Myanmar, Thailand and Malaysia have through quality, simplicity and cost efficiency gained significant scale: 55% of the group’s EBITDA originated from Asia in 1H 2015.

In its home market, Norway, Telenor is the undisputed leader with a revenue market share of 52% – in total and within mobile – in 2014.

But before we conclude on Telenor’s local superiority, we should remember that Norway (who isn’t part of the European Union) has had a low level of competition within telecom for decades. Norway’s mobile market was a duopoly until the end of 2011 – when Tele2 bought Network Norway and accelerated network rollout. So unfortunate then that Tele2 was left without any 4G frequencies in the auction conducted by the Norwegian authorities in the end of 2013. The highest bid was given by a mystery bidder and since the auction accepted sealed bids only, Tele2 wasn’t allowed to overbid and consequently thereafter made the only possible decision: To pull out of Norway. (Most of Tele2 was sold to one of the two remaining operational operators, TeliaSonera owned NetCom.)

The mystery bidder was later shown to be linked with the CDMA450 data-only provider Ice.net which still today hasn’t launch mobile services on its own network.

Let’s be clear on that Telenor had nothing to do with this regulatory flop, but it has clearly benefited Telenor

Whereas Telenor has proven to be both innovative and quick to react internationally, the company doesn’t have to exert itself too much in Norway. As long as Telenor build a reasonably good network (with Nordic standards), customers come and stay.

When we today add Telenor Norway to the Nonstop Retention Index (after it having won our poll), it will be on a position just below the historical industry typical with an index of 13.

This means that Telenor’s readiness to retain mobile postpaid customers in consumer segments isn’t bad, but mainly based on traditional retention tools. In a competitive context where customers aren’t locked in and have much flexibility and choice, Telenor with this index risks losing customers to competition.

There are elements in Telenor’s proposition in Norway which are differentiating – but to a higher extent than usual, Telenor’s proposition appears designed inside-out – based on what suits Telenor – rather than outside-in starting with customer preference and behaviours.

Particularly, it is the mix of policies – volume, throughput tiers, overage – used to monetise mobile data which pulls Telenor’s Nonstop Retention Index down.

Let’s go through the six categories that form the Nonstop Retention Index to explain how Telenor Norway gets an index of 13.

Inclusive value

Since Norway is one of Europe’s most expensive mobile markets, you might think there’s much included in Telenor’s mobile plans?

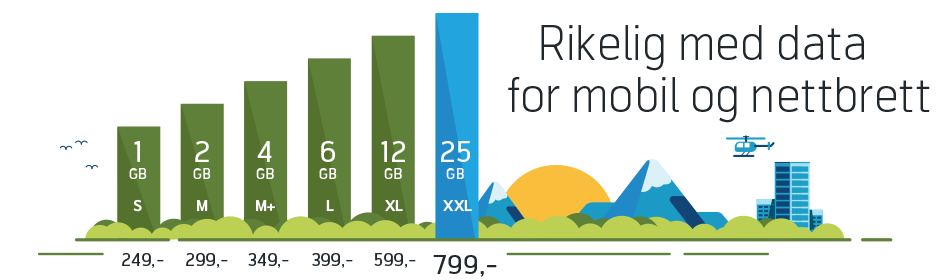

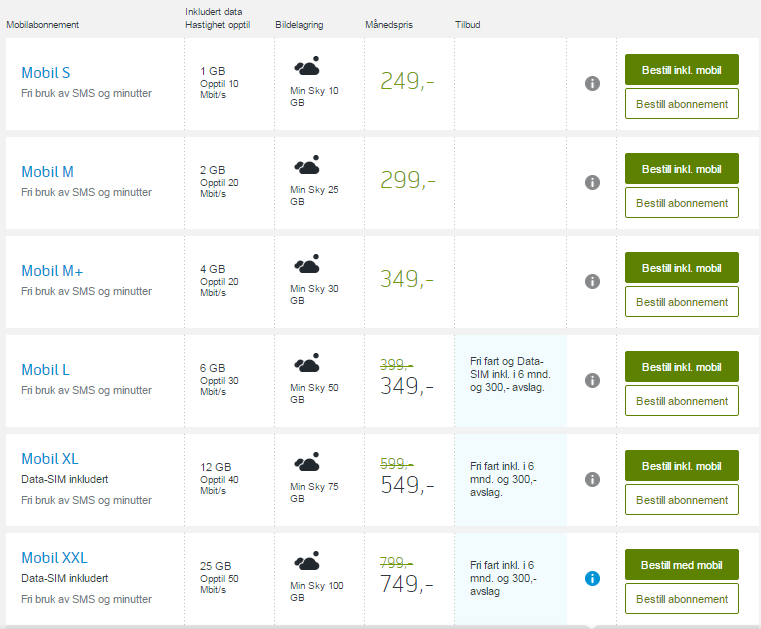

On the contrary; inclusive value is a weak category for Telenor. In February, Telenor reworked its plan setup (see picture above) and even though some plans got a bit more mobile data, the most expensive plans became even more expensive.

Telenor decided that XL and XXL customers must have an inclusive data-only SIM. An included extra-SIM is good for the index – but at the same time Telenor raised those prices significantly. For customers who previously had two separate subscriptions, one mobile and one data-only, both from Telenor, this change might have been neutral, but for the majority it just meant a price increase.

In contrast to NetCom, who provides customers on all but their entry plan with 1000 call minutes to use in the Nordic countries, Telenor doesn’t include any roaming in any plan. Telenor in Denmark, facing a more competitive market, includes roaming at price points that are lower than the entry plan offered by Telenor in Norway.

Inclusive content then? Well, all Telenor subscriptions include Min Sky – Telenor’s own cloud storage for images. Since there are plenty of free third-party options for this, we have not attributed any value to this, though. If Telenor wish to improve its index, it should include premium content services.

What Telenor does include, though, is public Wi-Fi. And every customer gets it. Telenor hardly mentions this differentiator, though. Is it seen as negative for the revenue generation? Or is it a reflection of that that public Wi-Fi network is limited – just 420 locations country-wide? Since inclusive Wi-Fi has a positive impact on customer retention, Telenor’s Nonstop Retention Index is affected positively by the inclusion – even if the network is small.

Telenor customers who combined fixed and mobile services aren’t given any additional value or discount – again in contrast to Telenor’s offers in Denmark. But on that note, Telenor Norway yesterday launched a service guarantee on fixed broadband:

Customers who experience outage on their fixed broadband will be compensated with 15 GB of mobile data (valid for 5 days) if the fixed broadband problem isn’t immediately fixed. Great! But it’s only customers with a Telenor mobile subscription who get it. If you happen to have another provider’s SIM, it’s your problem. As such, this has no impact on Telenor’s Nonstop Retention Index (which is defined for mobile), but an indication of inside-out thinking: If the fixed broadband connection is down, Telenor should solve the customer’s issue. If that solution is to provide the customer with mobile data; fine, but it needs to be a solution for all, not just those who also happen to have a Telenor SIM.

No waste of data

Scores are weak for Telenor in this category as well: Unlimited plans aren’t offered and Telenor doesn’t allow any unused data to rollover to next month. This is true also for top-ups: If a customer top up the last day of a month, the unused data is voided at midnight the same day. The Nonstop Retention Index improves to 15 if Telenor changes this – just for top-ups.

What saves Telenor’s index somewhat is the already mentioned fact that an additional data-SIM (sharing the same allowance) comes included with the XL and XXL plans. We need to point out that these two plans are very expensive, though: 599 and 799 NOK respectively [63 and 83 EUR]. With these prices, the throughput is still throttled – respectively to 40 and 50 Mbit/s. Want full speed? Then you need to pay 99 NOK extra per month, making the total 73 and 94 EUR respectively. Just for the service.

Currently, Telenor gives new customers on the L, XL and XXL plans full speed (up to 300 Mbit/s) in 6 months without additional charge. If the customer doesn’t cancel the option after those months, it automatically prolongs and start costing 99 NOK extra per month. Since it is a time-limited promotion, it has no impact on the Nonstop Retention Index, but this auto-prolongation (too) signals inside-out thinking.

We will come back to Telenor’s speed tiers and policy in the Buying experience & rating category.

Contract freedom & fairness

Telenor binds consumer customers who buy a handset for 12 months. This is the longest binding period agreed between the industry and the consumer protection authority in Norway, but still shorter than the industry-typical 24 months of many other markets.

Customers who take SIM-only plans aren’t bound, though. This helps the index.

Customers who have bought a handset can downgrade their service plan while still in binding – if paying an unspecified penalty. Upgrades are fine, though. If a customer wants to cancel a service while still in binding then he or she needs to pay an early termination fee. The only way to find out how high this fee is to log into Telenor’s self-serve tool (or contact customer service).

There is a lack of transparency about these fees. Existing customers could find out, but joining customers just have to wait and see. Contract freedom & fairness is consequently another relatively weak category for Telenor.

Buying experience & rating

Telenor’s buying experience is quite average for the industry: Since everything has been standardised into six plans, there’s not many choices to make. Consumers aren’t forced to make decisions on a lot of extras either: Just pick and click.

But the devil is in the details. Unlike most operators, Telenor pulls in all monetisation levers at the same time:

- Data volume

- Data throughput

- Overage policy

- Data-only

Let’s say you want low data volume but high throughput. The Mobil S plan above comes with 1 GB. Already this is above the Norwegian average usage (which was just above 800 MB in 2014). But then you need to settle with a maximum of 10 Mbit/s which, even though Telenor calls it 4G, is a lower speed than what 3G networks deliver.

The only way to get higher speed is to pay more. But not even if you pay three times as much (going with the XXL plan), you get more than 50 Mbit/s. (But you do get a whole lot of gigabites and an extra data-SIM which you didn’t ask for.)

Telenor has also hidden critical policy information under the “i” buttons.

It’s only after a customer has clicked on the “i” button that it becomes clear that Telenor charges overage fees for out-of-bundle data in the S, M, M+ and L plans. It’s not marginal either: Every megabyte is 5 NOK up to a maximum of 399 NOK per month. That’s 42 EUR extra.

Going above your monthly allowance with just 80 Mbyte will cost as much as a complete Mobil L subscription with 6 GB and unlimited voice and SMS

Telenor will of course send customers an SMS before this happens, but still: Such overage fees are disproportionate and penalising. Telenor’s customers can subscribe to Datakontroll Norge, a free service, to gain control over their usage. But customers need to take action themselves since it’s an opt-in service. It should of course be standard.

When finding out that, in contrast, the most expensive plans don’t have an overage fee (XL and XXL customers can continue using data after the cap is reached but with speed throttled to a low level), a cynic could suspect that Telenor designed its policy so that customers have to pay more – either voluntarily by going for the premium plans or involuntarily by paying hefty overage fees.

Telenor features the most customer unfriendly terms & conditions we have registered to date. In fairness, the policy of NetCom isn’t much better. What a differentiation it would be for either of the two operators to change it!

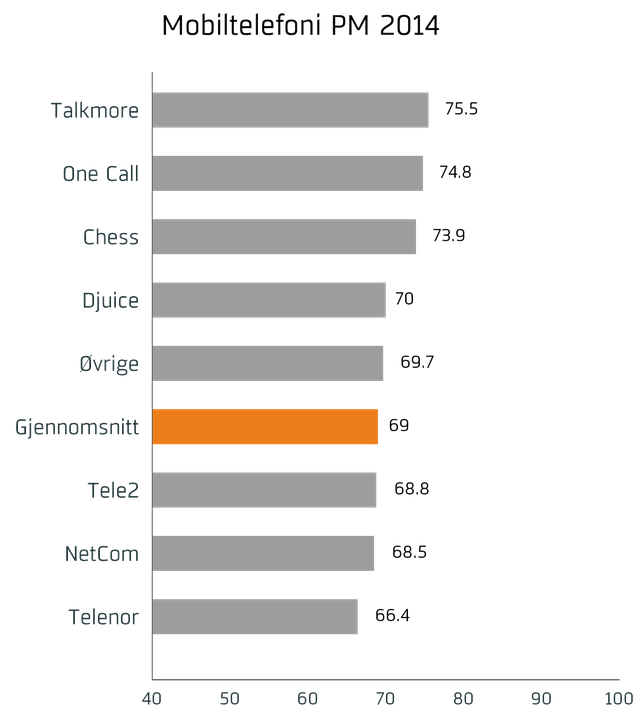

Customers seem to have noticed, though: In EPSI’s latest customer satisfaction report on Norway, the Telenor brand has the lowest satisfaction score of all mobile brands.

Put together in a Nonstop Retention Index context, Telenor has the lowest score of all mobile brands in the buying experience & rating category to date. If Telenor wants to improve its Nonstop Retention Index, this is where it would pay off best to start. The upside is very significant.

Community & following

Telenor allows up to 6 mobile consumer or business subscriptions (though maximum 3 prepaid) – and one fixed subscription to take part in a FriFamilie group. The potential benefit is that these numbers can call and text each other even if there’s no balance left. Since all of Telenor’s regular postpaid plans come with unlimited voice and texts, the benefit is perhaps not obvious, but for families which still have some prepaid cards, this might be cost beneficial and provide a feeling of safety. Even though the added value is limited (again we can compare to the very substantial multi-user discounts Telenor gives in Denmark), the construction should have a positive effect on customer loyalty and the Nonstop Retention Index is thereby affected positively.

To improve further in this category, Telenor could look at referral and loyalty programs plus use Twitter more to grow a fan base.

Handset flexibility

As said, a customer who buys a handset from Telenor is bound for 12 months. This also means that if he/she wants a new handset during that binding period, he or she needs to pay a break-up fee to Telenor. This means, most likely, that few customers go for this option. 12 months is not a long waiting period, though.

If a customer is willing to be bound for 12 new months, Telenor allows customers to buy a new handset after 11 months.

Unlike NetCom, Telenor doesn’t any longer promote a handset trade-in program. There’s no early upgrade program (like what Telenor has in Sweden) nor are there any lease options.

Before summarising, it’s important to point out that Telenor Norway doesn’t have the lowest Nonstop Retention Index. The index is 13, which actually is just below what a few years ago would have been considered industry typical (14).

While Telenor thereby obviously does some things right already, it is disappointing to see how Telenor uses policy in a way which is enforcing and non-transparent. In other industries, we see this happen with aggressive low-cost players like Ryanair, but we don’t expect this from old, solid, responsible companies. Telenor is successful in other markets without using similar inside-out tactics.