Telekom, Germany’s incumbent operator, updated its MagentaMobil postpaid offers two weeks ago.

But the changes, including an increase in data volumes, higher throughput (Telekom has tiers) and an increased validity of top-up data weren’t enough for a high Nonstop Retention Index: Telekom is the first brand to join the list with a negative index, -3.

The contrast to the top-ranked family member T-Mobile USA is obvious.

Still, the changes mark an improvement for Telekom in Nonstop Retention and the below three-times-written sentence in a recent announcement promising “more speed, more data and more fairness” indicates that Telekom indeed has an aspiration to keep customers loyal with more subtle means than lock-in:

“Deutsche Telekom is offering all these extras at the same price”

So let’s look at the six categories building up the Nonstop Retention Index and see what Telekom could do to improve further:

Inclusive value

This category has the highest weight in the Nonstop Retention Index. And Telekom have pulled out some of the right tools from the toolbox: Inclusive Wi-Fi and inclusive roaming. It would have been perfect for the index, had these benefits not been offered exclusively with only one plan: the premium MagentaMobil L Plus. It costs 79,95 EUR for SIM-only (after 12 months of 71,95) – a price level which is unparalleled in EU outside of Germany. If you add a handset to it, the price reaches 99,95 EUR per month. If Telekom would have included Wi-Fi and roaming on all plans, not just the most expensive one, their index would have been +3, not -3.

What Telekom does provide to all MagentaMobil customers is free Spotify. It’s two times free to begin with: It comes without the monthly, regular, Spotify fee of 9,95 EUR. But it is also zero-rated. This means that any MagentaMobil customer can stream the music he/she wants regardless of data allowance. Great for the index – had it not been for the three month limitation. After those test months, customers have to pay the 9,95 EUR. The zero-rating continues, though.

The ultimate goal of Telekom is to get customers to go for their quad-play product line MagentaEINS. And if customers do, they get full 4G throughput (which they might have already), unlimited calls (which they might have already) and – of course; this is quad-play – a discount. Regardless, it’s positive for Telekom’s Nonstop Retention Index.

No waste of data

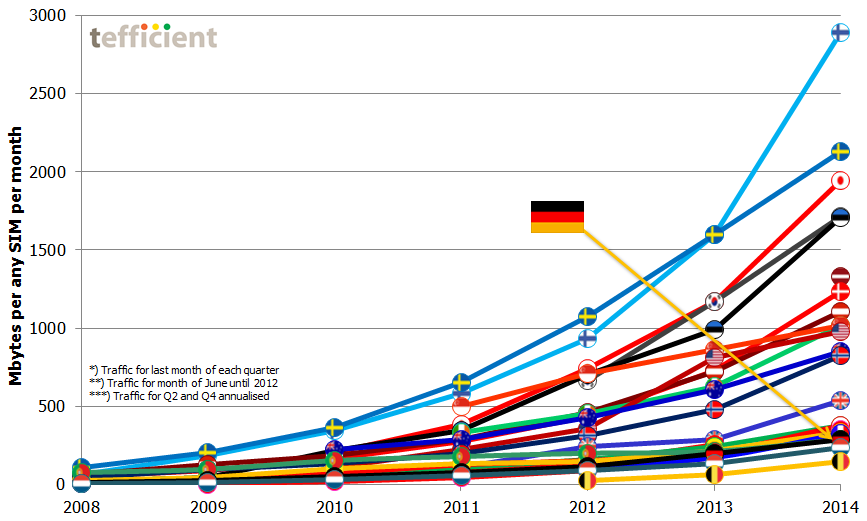

German customers haven’t yet discovered mobile data – the average usage per SIM was a low 287 Mbytes per month in 2014.

Given this, it’s perhaps not surprising that Telekom isn’t making a lot within this category: No unlimited plans, no rollover, no multi-user data sharing and data sharing with a secondary SIM only on the most expensive plan (same as above).

As part of its changes to the MagentaMobil plans, Telekom increased the validity of top-up data to 31 days – previously also the top-up data died by the end of each month – but if Telekom wants a higher Nonstop Retention Index, it needs to make top-ups valid forever. That single change would improve the index from -3 to 0.

Contract freedom & fairness

This is Telekom’s weak spot. All contracts – even SIM-only – are binding for 24 months. Customers are not given any flexibility when it comes to e.g. pausing or downgrading the service. Telekom doesn’t give customers the freedom to stay. And consequently their rating in the Nonstop Retention Index takes a beating.

Buying experience & rating

Similar to other markets, the operator brands aren’t the most preferred in Germany. Instead it’s the MVNOs and sub-brands who have high customer satisfaction. In DISQ’s survey from February 2015, Telekom has the 11th position (of 15 brands) – although it is ahead of E-plus, O2 and Vodafone (who comes last in the survey). The higher consumer rating together with its test-winning network, gives Telekom “a healthy average” score in consumer rating.

Telekom’s buying experience is also around average. The terms & conditions are long and complicated, navigating through them requires many clicks – and who can read a 6 pt font?

Community & following

Telekom has an advanced recommendation programme in which customers can select their bonuses in case friends follow their recommendations. There’s also a savings possibility for multi-user accounts as there’s a 10 EUR discount on the second user’s SIM. Both of these contribute positively to Telekom’s index.

Social media is not used much by the German operators and Telekom could improve its index by mobilising customers on Facebook and do much more on Twitter.

Handset flexibility

For the customer loyalty, it’s positive that Telekom has a handset trade-in program which allows customers to trade in their old handset and receive a voucher valid for Telekom’s products or services.

Some operators – especially American – are successfully keeping customers by promising a future handset upgrade. With Telekom, there is an option to replace the handset every year, but it comes with two caveats: First, it costs 10 EUR extra per month. Secondly, the customers have to accept a prolongation of the binding contract with another 24 months. This combination of both payment and contract prolongation isn’t common and can be perceived as a trap by the customer when he/she comes to collect the upgrade he/she paid for.

This is yet an example of Telekom having access to the right tools, but refraining from using them unless customers pay a premium. To increase their rating in the Nonstop Retention Index, improving customer fairness and transparency of plans should be considered. Following T-Mobile USA’s lead, introducing non-binding alternatives would surely benefit also Telekom.