When we today add our 14th mobile brand to the Nonstop Retention Index, it’s from a market which stands out: Finland.

In a blog by tefficient, we called Finland “the land of three thousand megabytes”, but that title is now outdated – it should be “the land of five thousand megabytes” looking at the development of the average monthly consumption of mobile data per any SIM.

One explanation to Finland’s world-leading mobile data usage is that 47% of the SIMs (June 2015) have unlimited data.

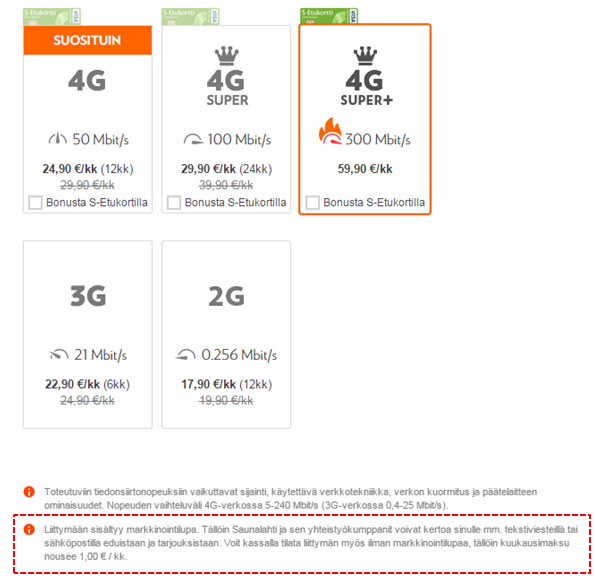

The operator with the highest market share in number of SIMs in Finland is Elisa. The company is also the prime explanation to why unlimited data still prevail in the offers from Finnish operators: Elisa has quite vocally defended the model with unlimited data – when combined with speed tiers (Elisa offers up to 300, 100, 50, 21 and 0,256 Mbit/s).

One of Elisa’s competitors, Sonera, left this unlimited approach to instead promote plans with high, shareable, allowances. After some time, Sonera took one step back, though, when re-introducing unlimited plans (albeit with a 6 EUR premium). The third operator, DNA, has been holding onto the unlimited model.

Another historical peculiarity of the Finnish market is the non-binding contracts. Finnish operators typically didn’t bundle subsidised handsets with binding service contracts, meaning that Finnish mobile customers bought handsets and mobile services separately. Today, this is not so peculiar anymore since that model has proven to improve business results and rapidly is adopted as the norm also in historical subsidy markets like e.g. the US. (You could argue that it’s Finland, not T-Mobile USA, who lead the world into decoupled, non-binding and unsubsidised).

With unlimited data and non-binding contracts, Elisa must be great in Nonstop Retention? Well, with an Nonstop Retention Index of 31, Elisa is good, but not great.

Let’s go through the six categories that make up the Nonstop Retention Index to explain:

Inclusive value

Mobile services are dirt cheap in Finland – for high usage customers. But if you aren’t using much data, then the entry price is quite high compared to countries where customers can select a service plan with the exact number of minutes, messages and data he or she needs.

The decision of the Finnish operators to, more or less, solely offer unlimited data makes it rather expensive to just consume, say, 300 megabytes per month

Since Elisa doesn’t include value adds like roaming or content in its base prices, the inclusive value category becomes a weak point. On the other hand, whereas operators with limited data score some inclusive value points when they permanently expand data allowances, one could argue that Elisa’s customers do that expansion of value themselves by simply using more data without paying more:

In the first half of 2015, Elisa’s data traffic grew 98% compared to the same period in 2014

The total Finnish data traffic grew 100% – which just shows that unlimited data isn’t differentiating Elisa’s offer in the market. The Finnish number 2, Sonera, includes roaming within the Nordic and Baltic countries in all of their plans (starting at 14,90 EUR). If Elisa did the same the index would improve from 31 to 35.

Elisa has a quite developed content offer, Elisa Viihde, and even if you can have access to the platform, premium content isn’t included in the mobile plans. Inclusive content would also improve the index.

Since Elisa is providing all of mobile, fixed and TV services, one could expect that Elisa would provide customers who take mobile and fixed services with certain value adds or discounts. Only customers who combine fixed and mobile broadband gets such a discount.

No waste of data

With its unlimited offers, Elisa does well in this category, but at the same time Elisa is a bit trapped in its model when e.g. data-SIMs can’t be allowed to be paired with a smartphone SIM (even though tethering is allowed).

If Elisa allowed paired data-SIMs under the same (unlimited) allowance, usage would be yet higher without any additional revenue – so it’s easy to understand why. As a consequence, the Finnish phone SIM market is one distinct market while data-SIM is another. A high 20% of all SIMs in the Finnish market are data-only.

Contract freedom & fairness

Once again Elisa is good, but not the best. Elisa – alongside with its competitors – are making frequent changes of their price points and terms which isn’t exactly reassuring for customers since they don’t know if the price they pay will be lower next week.

And even if Elisa technically doesn’t bind phone customers, it sells most of its plans with a promotional discount during the first 12 or 24 months of a service contract. The logic is of course that the price should appear to be lower and that customers should think again before churning since they will then lose their discount. Those built-in price increases are at the same time negative for customer retention, though: They are effectively penalising loyal customers.

And Elisa does bind some of their customers: Phone customers aren’t, but data-only customers are.

Buying experience & rating

The overall buying experience is no better and no worse than the industry overall. The same goes for the public rating of Elisa: The original Saunalahti mobile sub-brand used to be more popular and have higher customer satisfaction than Elisa, the company brand. Now that Elisa has re-branded everything as Elisa+something, the customer satisfaction as measured by external agencies could be expected to be around the national average.

On the terms and conditions, Elisa does one thing which is customer unfriendly:

Unless a customer gives his/her consent to be targeted for marketing messages, Elisa increases all price points by 1 EUR per month

This is communicated in a footnote which most customers likely are overlooking (the red dotted frame is inserted by us):

Small thing? No. This is deceptive. A customer should not have to be forced to pay extra to exercise his/her right to opt-out of marketing. Elisa’s Nonstop Retention Index takes a hit.

Community & following

It appears as if Elisa doesn’t have a referral program or a loyalty program (even though some Elisa customers can add some points to a certain retailer program).

Social media use and following is at the expected level; no more, no less.

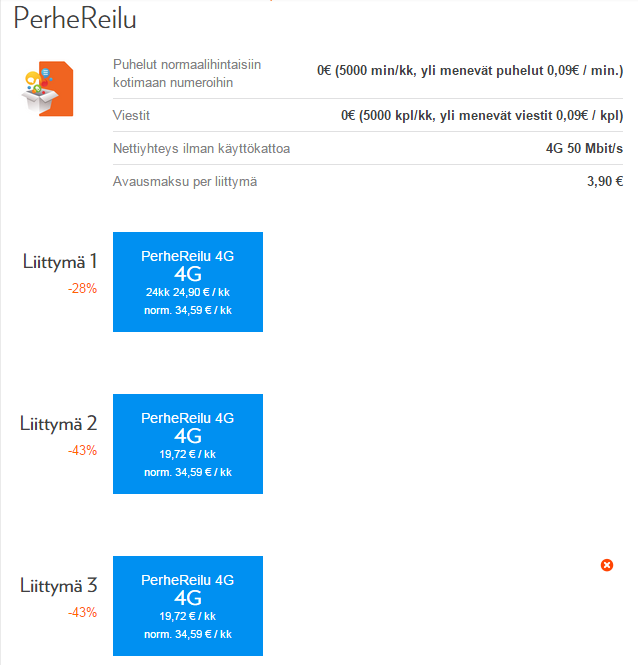

Within its PerheReilu plan, Elisa gives discounts to user groups with two to seven SIMs which improves the Nonstop Retention Index. It could have been more flexible, though: Now all users have to be on exactly the same 5000 minutes/5000 SMSs plan with unlimited data and 50 Mbit/s of maximum speed:

It would have been more elegant (and likely more attractive) would users within an account be able to individually select a plan.

Handset flexibility

As said, handsets are decoupled from Elisa’s service plans. Customers can pay for handsets either upfront or in 12, 24 or even 36 monthly installments. The total cost becomes the same, i.e. Elisa doesn’t subsidise handsets on installment plans, but they do help with the financing without charging extra for it.

At any point in time, an Elisa customer can pay the remaining installments and upgrade to a new handset. Noticeably, customers who have an equipment installment plan can continue to pay on it irrespective of the service plan. This means that the service plan can be upgraded, downgraded or even cancelled without any effect on the installment contract. Elisa is rewarded in the Nonstop Retention Index for this setup.

Elisa doesn’t have an early upgrade program or a handset trade-in program. Having it would improve Elisa’s index somewhat.

Relying on its unlimited and non-binding heritage, Elisa scores well in the Nonstop Retention Index without doing things that are differentiating in the local Finnish competitive context. Elisa can improve its index by removing the condition that customers should pay to opt out of marketing – and e.g. by including some roaming and premium content to mobile plans.